An enormous difference between domestic funds and you will commercial a residential property money is basically just who the new debtor ismercial assets funds are not accessible to some one, but alternatively limited liability businesses, limited-liability partnerships, standard partnerships, S providers, and you can C enterprises.

Even if somebody might theoretically safe money to possess a small investment property (age.grams. duplex) due to the fact a just holder, this fundamentally isn’t really recommended and generally isn’t felt a true commercial assets loanmercial property investment is often to possess LLCs, LLPs, GPs, S Corps, and you may C Corps which have huge qualities (e.grams. minimal 5-device multifamilies, organizations, stores, an such like.).

Drifting cost change-over the category regarding a loan because field costs to switch, tend to changing immediately following per year. Fixed pricing are set for the duration of the mortgage.

Lenders consider the property, borrower, business cost, or other activities when setting interest rates. Government-recognized loan programs either provides some lower interest levels.

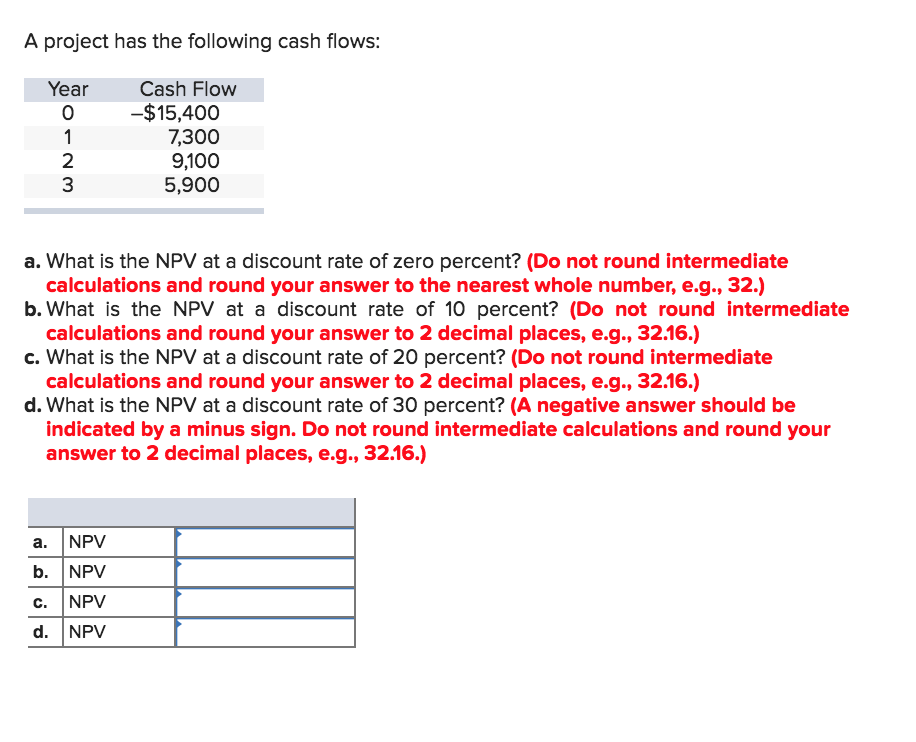

Industrial Loan calculator

Once the an effective loan’s fees plan try influenced by new loan’s name, amortization, harmony, interest framework, and you will rate of interest, yourself calculating installment try troublesome. A loan calculator makes it simple to see exactly how payment change given that interest or any other circumstances transform, even when.

Significantly, traders is to play with a commercial online calculator in lieu of a residential financial calculator. Domestic home loan hand calculators wouldn’t effectively make up different points that apply to industrial loan repayment schedules.

The requirements and features out of industrial home finance are quite brand of compared to that category of loan. Here are the specific terms and conditions to learn whenever obtaining it version of capital.

Payment Schedule

Industrial mortgage installment dates derive from label and you may amortization, and they seem to vary durations. The expression is when much time regular money would be made. The fresh new amortization is the duration that’s familiar with determine those individuals regular repayments.

Such as for instance, a professional possessions loan may have a good ten-12 months name and 31-year amortization. The typical money (usually monthly) was determined because if the loan perform simply take three decades to repay. New payments manage just be created for ten years, from which big date a huge payment might be expected to clear the rest equilibrium of your own mortgage.

Just like the label is frequently shorter than amortization, balloon costs are all having industrial possessions fund. Investors appear to perform balloon costs from the refinancing or promoting, but simply using them are, of course, acceptable.

Loan-to-worth

Loan-to-worth percentages assess the balance regarding a professional possessions mortgage facing the value of a funded assets. Loan software features limitation invited LTVs with the intention that lenders you should never imagine extreme chance.

A maximum allowed LTV out-of 80% is typical, many apps have other acceptance maximums. Non-secured apps have lower LTV standards. Secured apps might have slightly large LTV allowances.

Debt-Provider Visibility (DSCR)

Debt-services exposure ratios measure a property’s income resistant to the property’s debt. Lenders fool around with DSCR to check on whether property have enough money to solution its monthly personal debt payments.

Internet working earnings encompasses good property’s income reduced the working expenditures. Debt provider encompasses the attention costs and you can dominating paying, usually of all the fund toward possessions.

Prepayment Penalty

Prepayment punishment is actually billed when a professional property mortgage try completely repaid through to the maturation big date. Loan providers fool around with prepayment charges to make certain at the least a fraction of its questioned return into a loan. Penalties are of all sort of industrial a home loans.

- Lockout Months: Doesn’t allow it to be early cost throughout that point

- Fixed Percentage: Assesses a fixed commission fee if the totally paid off very early

- Step down: Assesses a portion payment one instant same day payday loans online Utah to decrease after a while